On May 27th, Sirma Group Holding presented its financials for Q1 2025 during a webinar hosted by the company’s top management, Tsvetan Alexiev, CEO, and Yordan Nedev, CFO.

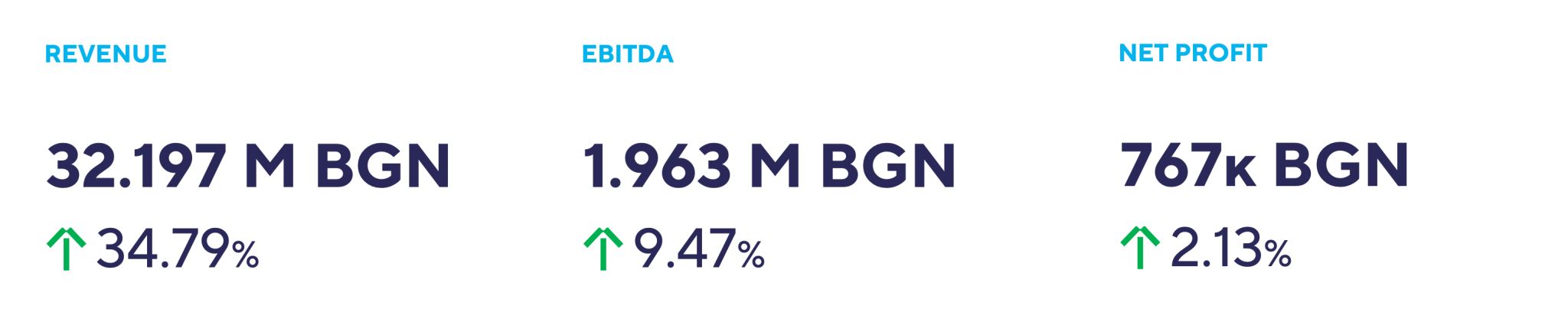

Sirma Group reported a 34% increase in revenue for the first quarter (Q1) of 2025, according to its interim consolidated report. The company’s sales exceeded BGN 32 million. The primary revenue stream for Sirma Group comes from Europe, which accounts for 80.46% of total sales. North America is the second-largest market, contributing 11.57%.

Among its diverse range of services, systems integration was the most significant revenue contributor, making up 47% of sales (BGN 15,214 thousand). This was followed by IT services at 11% (BGN 6,076 thousand) and the financial industry at 8% (BGN 3,844 thousand).

Additionally, the financial results indicate a 9.47% increase in earnings before interest, taxes, and depreciation (EBITDA). The company’s net profit also grew, reaching BGN 767 thousand, reflecting an increase of 2.13%. Read the detailed report here.

Additionally, the financial results indicate a 9.47% increase in earnings before interest, taxes, and depreciation (EBITDA). The company’s net profit also grew, reaching BGN 767 thousand, reflecting an increase of 2.13%. Read the detailed report here.

Tsvetan Alexiev, CEO of Sirma Group, shared,

“In a volatile geopolitical environment, first quarter growth of nearly 35% is a very good achievement as changes in global politics and trade create significant uncertainty for technology businesses worldwide. I believe, that with our well-planned strategy and broad portfolio of services, we will continue to grow in 2025 and follow the outlined plan to reach €100 million turnover in the short term of 2-3 years and a successful listing on the Frankfurt Stock Exchange by early 2026. ” He also added, “Since the inception of Sirma Group, Artificial Intelligence (AI) has been embedded in our DNA and in all the services we offer. This growth will continue as we assist and advise our clients in their AI transformation and help them become AI-ready and prepared to implement large-scale AI solutions in their critical operations and processes”.

During the webinar, management mentioned that the synergistic effects from merging the subsidiaries into Sirma Group Holding have already started to optimize overal proccesses, shared resources and also resulted in increased profits, which benefit all stakeholders. They also answered several questions about future plans for mergers and acquisitions, including the types of businesses they are targeting for acquisition. Additionally, they discussed the company’s vision for balancing its dividend policy with decisions regarding share buybacks.